Overview of the Disposable Vape Market in Germany

10 July 2024

Introduction

In recent years, the disposable vape market has experienced rapid growth. Disposable vapes have quickly captured the market due to their convenience and a wide variety of flavors. But what about the German market? How has it evolved, and what are the key trends and consumer behaviors shaping this segment? In this article, we will explore the current state of the disposable vape market in Germany, looking at the consumer demographics, distribution channels, top online platforms, popular e-liquid brands, and more.

Related: E-Cigarette Regulations in Germany

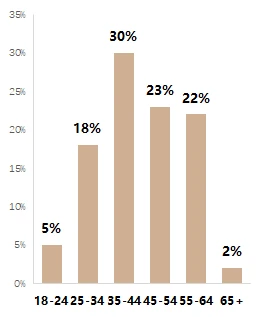

Age Structure of German Vapers

In Germany, 77% of e-cigarette users are aged 35 and above. The average age of the German population in 2023 was 44.9 , with around 18 million people aged 65 and over, accounting for 22% of the total population. Germany's aging population is second only to Japan, making it the leading Western country in terms of aging demographics.

Consumer Habits of German Vapers

German consumers are particular about product quality and place a high value on pre-sales consultations and after-sales services. They pay close attention to product descriptions, as Germans prefer detailed and factual information. Online shoppers in Germany favor websites with German content and .de domains.

Germany has a well-developed logistics network, ensuring fast delivery, but it also has a high return rate, the highest in Europe. Price comparison is a common practice among German consumers, who frequently use specialized comparison websites to find the best deals. Products must match their descriptions and images accurately.

Key shopping periods include:

- Summer sales: Late July to early August (around two weeks)

- Winter sales: Late January to early February (around two weeks)

The months of July, August, and September are typically slow due to vacation periods.

Distribution Channels

Online shopping is the preferred channel for German e-cigarette users, especially for hardware (kits and accessories). The main reason consumers avoid buying from vape shops is the high price. Germany has approximately 1,500 vape shops, but online platforms remain dominant due to competitive pricing.

Source Countries of Popular Online Products

Germany's popular products mainly come from:

- UK: 29.17%

- China: 20.83%

- Germany: 12.5%

E-liquid manufacturers dominate the market, with 45.83% of popular products coming from this sector. Among these, UK e-liquid manufacturers lead with 54.55%, followed by the US at 18.18%, and German local manufacturers at 9.09%. Prominent German brands include LYNDEN and The Bros. To penetrate the German market, it's advantageous to collaborate with international brands like IVG, Pod Salt, Frumist, and Dinner Lady.

Top Online Platforms

The German disposable vape market is supported by several prominent online platforms, including:

- Riccardo-zigarette.de

- Dampfdorado.de

- Intaste.de

- Dampfplanet.de

- Innocigs.com

- Dampftbeidir.de

- Zazo.de

- Dampfalarm.de

- Steam-time.de

These platforms provide a range of vaping products, making it convenient for consumers to find their preferred brands and accessories.

Top E-Liquid Brands

Popular e-liquid brands in Germany include:

- Dinner Lady

- Vampire Vape

- Tom Klark’s

- Six Licks

- Sique Berlin

- Antimatter

- Twelve Monkeys

- Damp flion

- Pod Salt

These brands are favored for their diverse flavors and high quality, catering to the varied tastes of German consumers.

Search Popularity of Disposable Vape Brands

In the past year, search trends for disposable vape brands in Germany were as follows:

- ELF BAR: 35

- Smok: 18

- IVG: 8

- Innokin: 2

- VAAL: 2

- Dinner Lady: 2

- Geek Bar: 1

- Exvape: 1

- Vbar: 1

- VQUBE: 1

- Pod Salt: 1

- Totally Wicked: 1

- VOZOL: 0

User Reviews of Popular Products

Consumers of ELF Bar products focus on flavor, usage duration, and design. While flavors like those of Exvape Expod are popular for their refreshing taste, some users have criticized ELF Bar for not lasting the advertised 600 puffs, with the battery depleting prematurely.

Summary

Germany's aging population and high proportion of older e-cigarette consumers create a unique market dynamic. With 77% of vapers over 35 years old, and a significant DIY culture (47% of consumers prefer to mix their own e-liquids), there's a preference for customizing nicotine levels and flavors. The market is also influenced by the presence of UK and French disposable brands, which are gaining traction. Products that emphasize functionality and clear, detailed descriptions are well-received.

Popular product designs include cylindrical and box shapes, with flat designs also finding favor among German consumers. For instance, the dual-color injection molding and ice cream-shaped design of the MOTI POP appeals to German tastes.

In terms of flavors, berry and refreshing flavors (e.g., mint, lemon) are popular. Products with 0mg and 20mg nicotine strengths are also in demand. The market shows potential for international brands to establish a strong presence by catering to these preferences.